Investments With High Rates of Return Are Generally Accompanied With

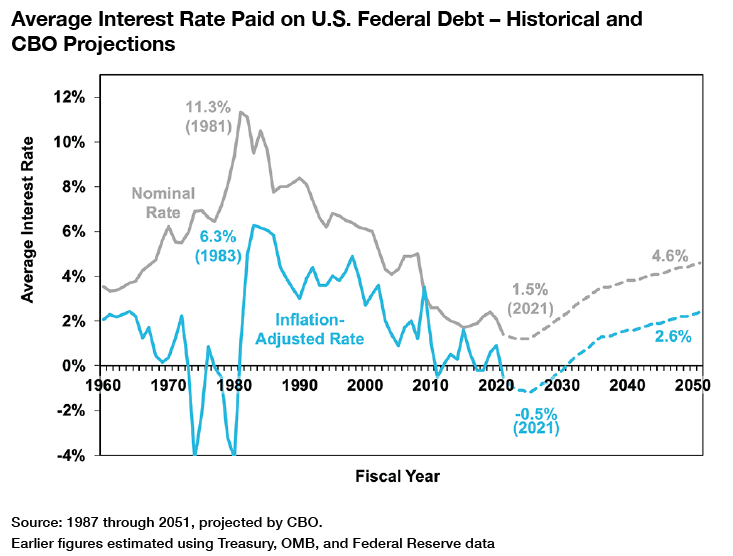

Yet since the early 1980s interest rates have generally been on the decline. Higher returns come with higher risk.

Are Hotels A Hedge Against Inflation In The Modern Era Cbre

Any investment with the potential of returns is accompanied with risk meaning that a potential of highlow return involves highlow risk.

. The stock market has long been considered the source of the highest historical returns. The high allocation of insurers assets to bond investments a particular implication may be the potential for investment losses on these portfolios as a slowing economy increases the risk of corporate bond defaults. Risk is absolutely fundamental to investing.

And higher dividend is generally accompanied by an increase in the stock price. Alternative investments often have the highest risk but with the possibility of the highest rate of return. The 19801990 period generally saw yields in the mid-teens.

The real estate investment trusts utilities consumer staples and telecommunication RUST sector is the one that investors must keep a close eye on when rates begin to climb. Even during the lows of the late 1990s high-yield bonds still yielded 8 to 9. Alternative investments can be real estate private equity commodities or hedge funds.

During the 20042007 interval yields hovered between 75 to 8 which were record lows at the time. The CSA encourages investors to watch out for the following red flags in order to avoid investment scams. As pointed out a high distribution rate can be accompanied by a declining share price return.

Alternative investments are any investments other than the traditional asset classes fixed-income cash and equities. Close to 80 billion in US. No discussion of returns or performance is meaningful without at least some mention of the risk involved.

9 One characteristic of mid-cap stocks is that they A are generally new firms with high growth potential B tend to be highly volatile. By keeping your eye on the total return you will not get suckered into purchasing a CEF with a high distribution rate and a declining share price return. While product names and descriptions change frequently examples of high-risk investments might include.

Even as the recovery continued investment remained sluggish Hall2015Guti errez and Philippon2017. C acquisitions of competing companies. High rates of return on your investments are wonderful because you dont have to invest as much capital to reach your investing goals.

APRAs quarterly data already show that Australian life and non-life insurers recorded negative investment income in Q1 2020. If a CEFs distribution rate looks too good to be true it is. Real estate in particular is an asset class to watch as rising rates can push home-buying out of reach for certain borrowers.

Generally the higher the return the higher the level of risk. The acquiring firms required rate of return in most horizontal mergers will not be affected because the 2 firms will have similar betas. B high rates of growth in operations and earnings.

High return bonds or mini-bonds which are often advertised as eligible to be included in Individual Savings Accounts ISAs innovative finance ISAs IFISAs unregulated collective investment schemes UCIS some structured products. It is known that higher the return other things being equal higher the market value and vice versa. Generally high-net-worth investors find that the unique services offered by commission-based firms provide the best investment returns and often are accompanied by white-glove treatment and other personalized services.

Make sure the opportunity is suitable for your investment goals before. This is consistent. Corporate bonds currently rated BBB potentially could be downgraded below investment grade in 2018 according to our estimates.

Fidelity Investments has also issued an alert on this scam. The projects promising a high average profit are generally accompanied by high risk. Corporate bond market have been accompanied by a steady decrease in overall credit quality and a trend toward higher leverage.

It is too good to be true. D strong performance even in market downturns. In the US 90-day investments of similar risk have a 4 annualized return and a 1.

Note that we didnt write it might be too good to be true. High-yield bonds also paid a much higher yield on average than they do now. Rates business investment recovered slowly from its collapse during the crisis and did not return to pre-crisis levels.

Ignore promises of guaranteed high returns with little or no risk. Those high rates were accompanied by sky-high increases in the cost of living inflation. Managers should accept such projects only if they will induce an increase in stock price.

Of course interest rates and more generally the cost of capital are not the only funda-mental determinant of investment. Stock prices are more volatile than bond prices. Years of significant growth in the US.

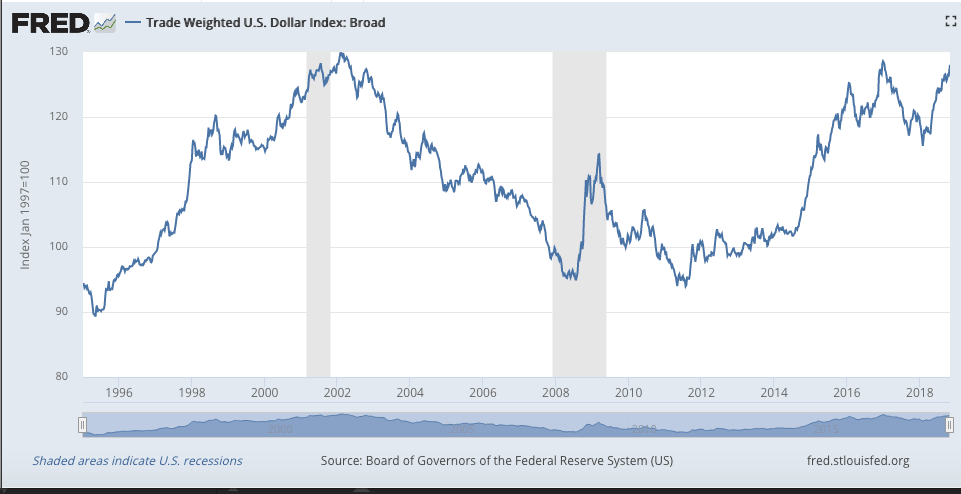

Is A Strong Economy Generally Accompanied By A Strong Currency Economics Help

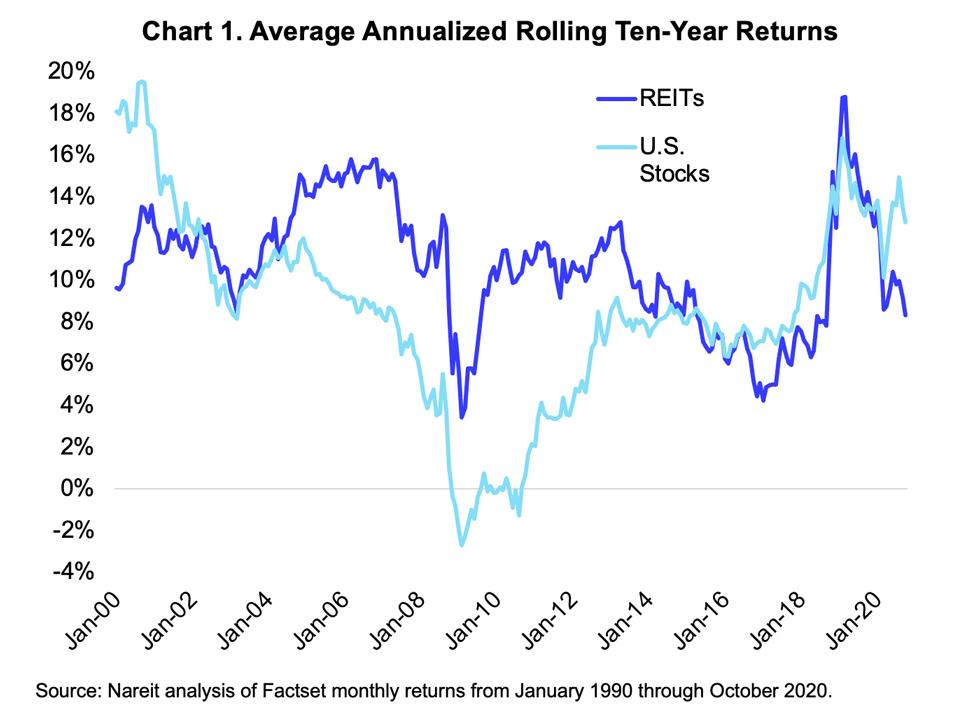

Reit Average Historical Returns Vs U S Stocks Nareit

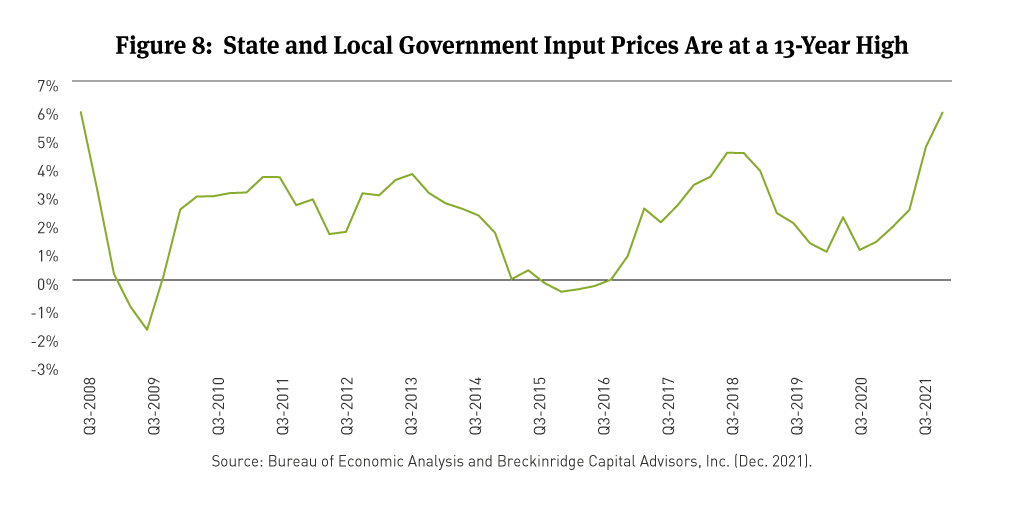

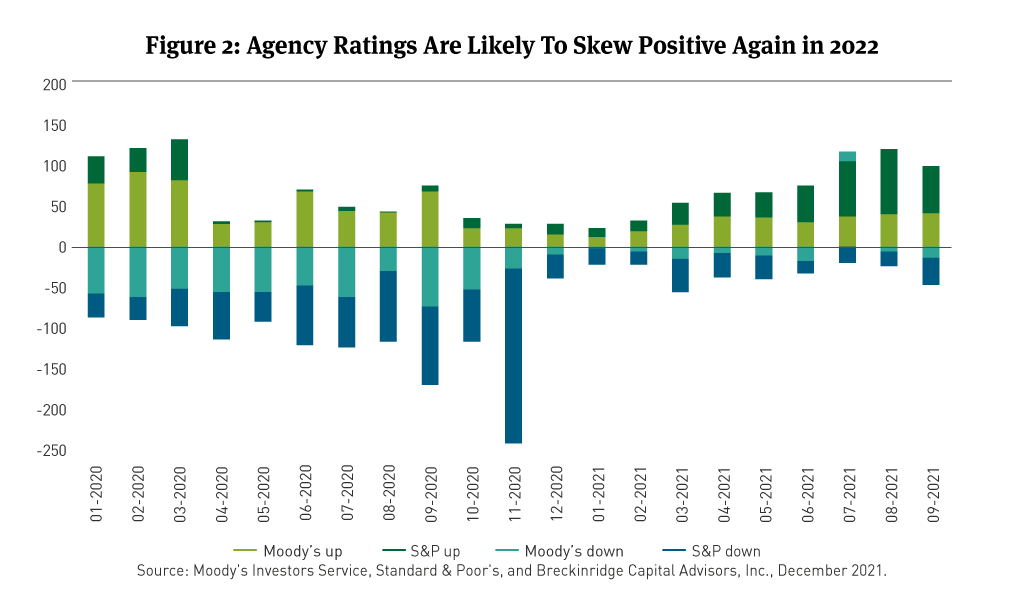

2022 Municipal Bond Market Outlook Breckinridge Capital Advisors

World Economic Situation And Prospects November 2021 Briefing No 155 Department Of Economic And Social Affairs

:max_bytes(150000):strip_icc()/dotdash_Final_The_Predictive_Powers_of_the_Bond_Yield_Curve_Dec_2020-01-5a077058fc3d4291bed41cfdd054cadd.jpg)

The Predictive Powers Of The Bond Yield Curve

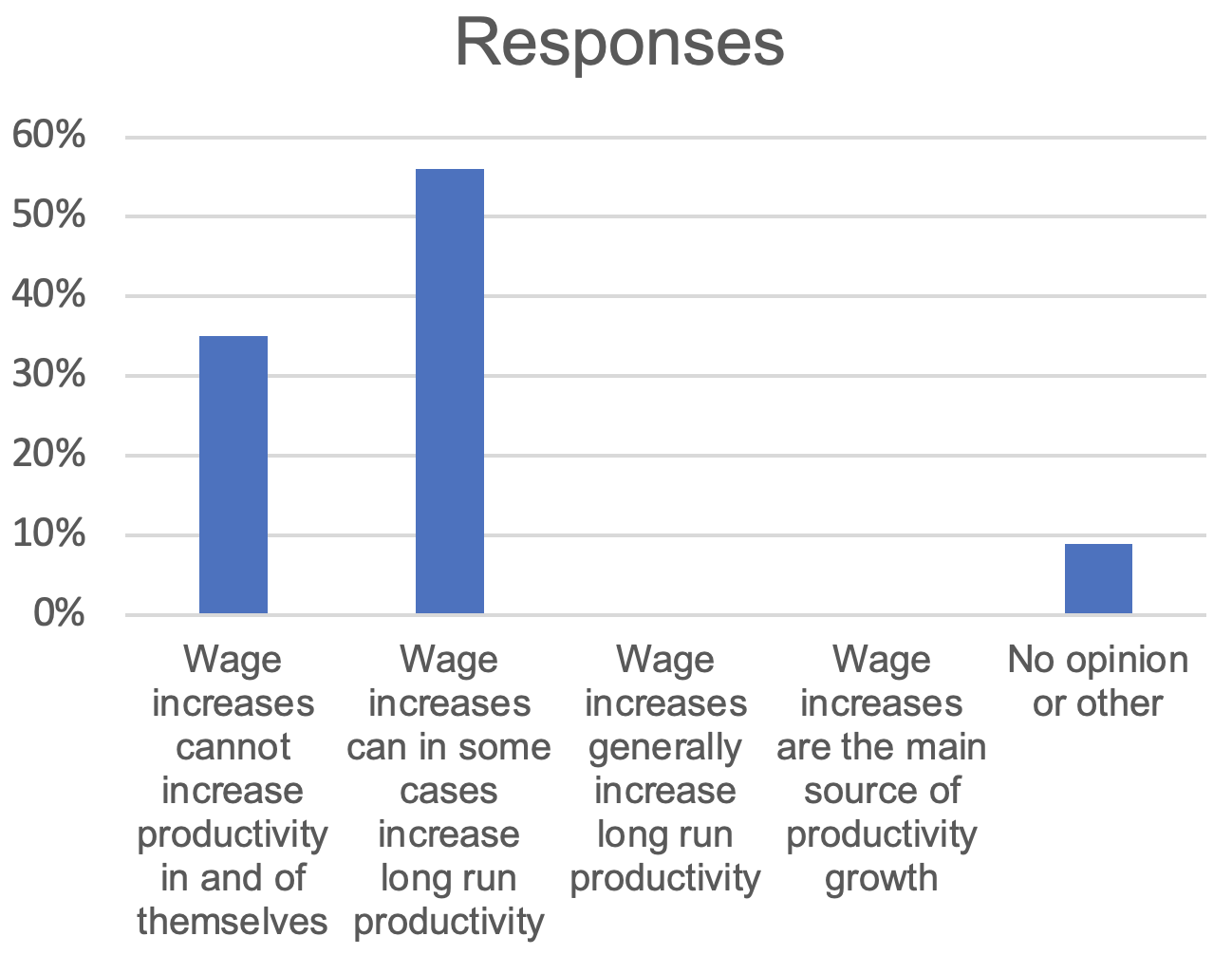

Towards A High Wage High Productivity Economy Vox Cepr Policy Portal

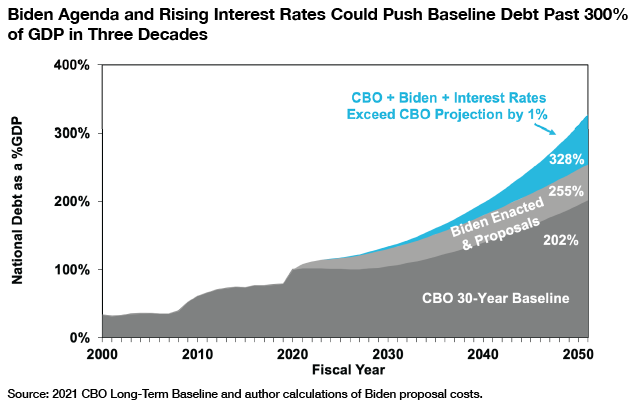

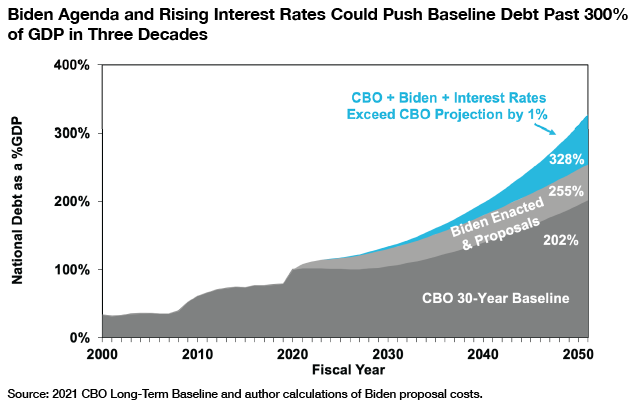

How Higher Interest Rates Could Push Washington Toward A Federal Debt Crisis

Jpmorgan Core Plus Bond Fund A J P Morgan Asset Management

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-0e9eaa2219934b4cb85c48fb9db7b45c.png)

Determining Risk And The Risk Pyramid

How Higher Interest Rates Could Push Washington Toward A Federal Debt Crisis

Return On Investment Roi Definition Equation How To Calculate It

Is A Strong Economy Generally Accompanied By A Strong Currency Economics Help

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Determining Risk And The Risk Pyramid

Unit 4 Economics Review Other Quiz Quizizz

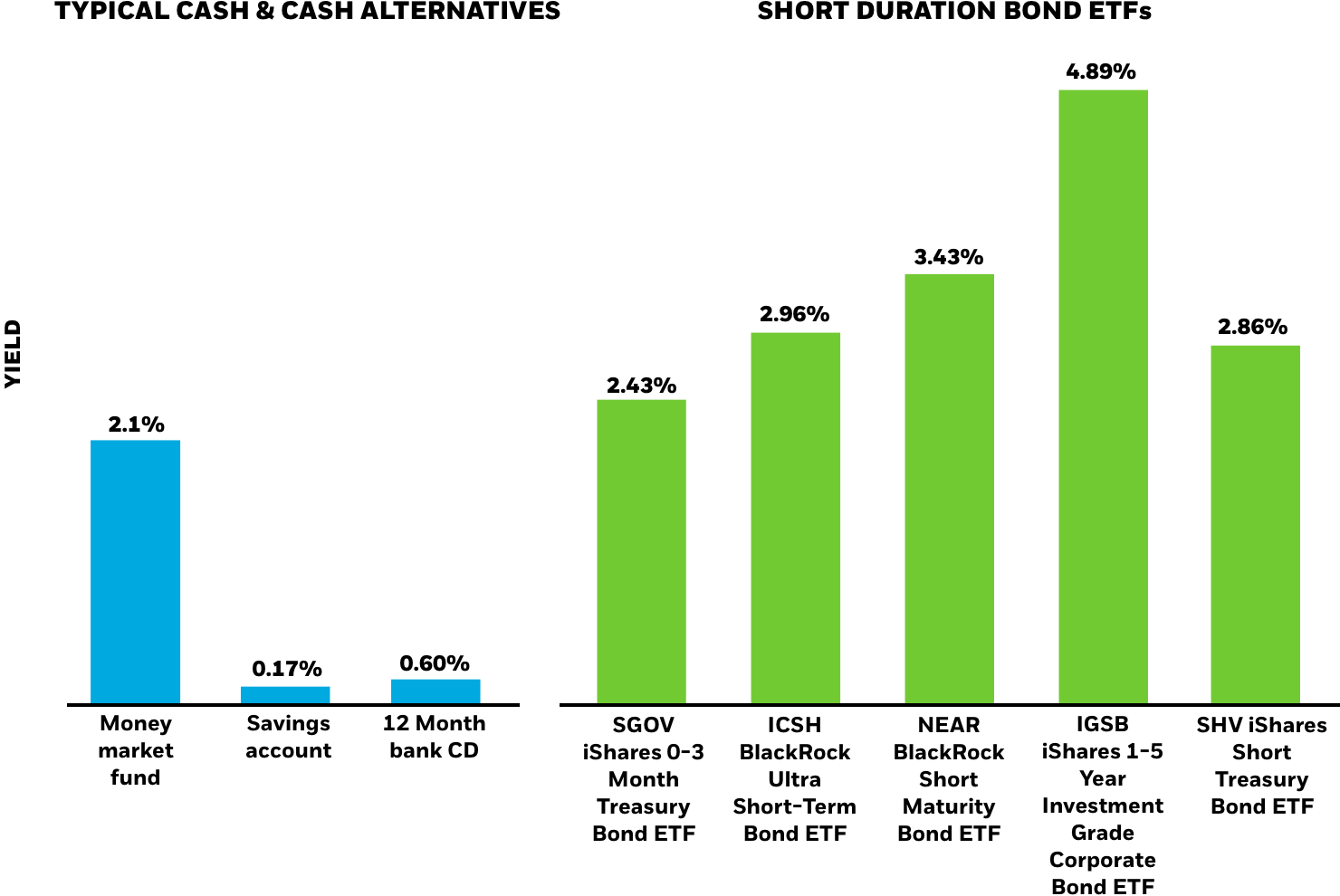

Put Your Cash To Work Ishares Blackrock

2022 Municipal Bond Market Outlook Breckinridge Capital Advisors

Are Hotels A Hedge Against Inflation In The Modern Era Cbre

Return On Investment Roi Definition Equation How To Calculate It

Are Hotels A Hedge Against Inflation In The Modern Era By Bram Gallagher

Comments

Post a Comment